Buying A House With Cash: The Pros And Cons

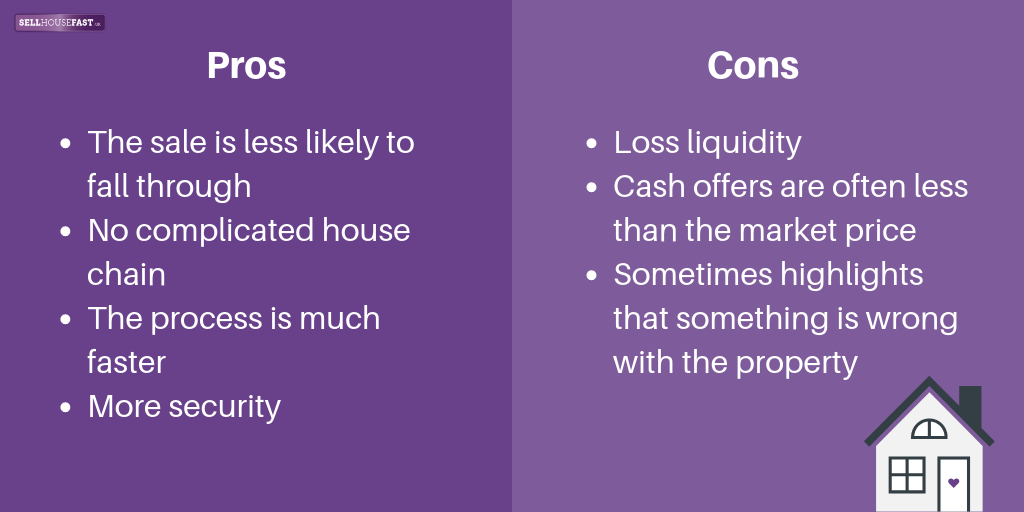

In this day and age, paying for a house with cash is becoming increasingly popular. Whether you are a buyer or seller, there are a number of reasons as to why cash transactions can be favourable, but it is entirely dependent on your specific needs. Like with anything, when buying or selling a house to a cash buyer, there are pros and cons.

What

is a cash buyer?

The meaning of a cash buyer is often misunderstood, with

some thinking that they are a cash buyer if they can afford to buy a house

without a mortgage once they have sold their current house. This is incorrect;

if a buyer doesn’t have the cash readily available at the current time of

putting in an offer, they are not cash buyers.

The official definition of a cash

buyer is:

“Someone who is able to buy, without needing to take out a loan or mortgage.”

What are the pros and cons of buying and selling a house with cash?

The

advantages:

The sale is less likely to fall through

Unlike other methods of selling a property, when a cash offer is accepted on a house, the sale is almost guaranteed to go ahead. By cutting out the middle man – the bank in this instance – you are taking away a great source of uncertainty as, according to research by the HomeOwners Alliance, just under a third of collapsed sales occurred as a result of the buyer’s finances not being in order.

As a result, accepting a cash offer can considerably reduce

the amount of stress of the financial transaction, where you may otherwise be

worrying whether the seller can raise the correct funds by the completion date.

Photo credit: 5 second Studio / Shutterstock

There is no complicated house chain

Another cash buyer advantage is that there is no reliance on other people in the chain, as the buyer doesn’t have to wait until someone has bought their property. Further research by the HomeOwners Alliance found that one in five sales collapsed after a sale further up the property chain fell through – the last thing you need, as a vendor, leaving you at risk of losing the house you are wanting to move into. So, if you are looking for a speedy sale, a cash buyer who isn’t tied down to a property chain is ideal for securing a successful deal.

If you do find yourself in a position where a buyer pulls out of the sale, considering a property cash buyer can be highly advantageous and will prevent delaying the process any further. If you are struggling to find a cash buyer, we can help you sell your house fast and complete within 7 to 28 days. Get in touch with us to find out more about what we can do for you.

The process is much faster

A further benefit of selling a house for cash is that when there is a cash buyer involved, property sales are often much quicker and straight-forward. If a person needs to secure a mortgage or loan from the bank, it is not instantaneous; they can expect to wait around a month from application (typically between 18-40 days).

A cash buyer, on the other hand, are ready to move in almost

immediately. They can be in their new home in a matter of weeks, once the legal

checks and surveys are completed. A cash buyer doesn’t necessarily have to

carry out surveys and legal checks – unlike mortgage buyers – so they may even

want to move in straightaway.

Photo credit: Alicia G. Monedero / Shutterstock

There is more security

In addition, when going through the process of buying a house with cash, you must consider a number of factors. For instance, you must ensure you are able meet your mortgage repayments each month after the purchase, otherwise you may face repossession or, even worse, homelessness.

Check out our guide on how to stop home repossession for more information.

Buying a house outright with cash means that if you lose

your job or get in some financial difficulty, you already own the property and

do not need to worry about losing your home. So, regardless of how bad things

may get financially, you are ensured a place to lay your head at night.

The

disadvantages:

Loss liquidity

It is fairly self-explanatory, but if you wish to buy a home

outright, you must make sure you still have enough money to cover other living

costs, such as food, drink and any house bills. If you have the funds to buy a

house in full and will still have enough disposable income left over, it may be

a great financial move for you.

Cash offers are often less

Cash buyers often put in an offer that is below asking price, in the hope it will be accepted because it’s a much faster process. Some property sellers decline cash offers because the offer has simply not been close enough to the asking price. However, if you are looking for a chain-free, quick house sale that is less likely to fall/encounter any problems, cash buyers are the perfect option for you.

Photo credit: create jobs 51 / Shutterstock

Could something be wrong with the property?

Some potential buyers get put off when estate agents specifically ask for “cash buyers only” as they believe it could be a sign that there is something wrong with the property. But there are several reasons why a seller could specify they would like cash buyers for their property.

For example, chief executive of the HomeOwners Alliance

Paula Higgins said:

“If a homeowner has found their dream property and has been given an ultimatum, for example that they have to be able to buy in the next three months – they may ask for cash buyers for their existing property to make sure the process goes quickly, and they don’t lose the property they want to purchase.”

So if you see this, do not be put off if you are in the position to do so, as it can be incredibly useful for both parties – buyers and sellers alike.

Share this image on your site:

Feature image credit: Photo credit: Ink Drop / Shutterstock