Dream Home Deposit Predictions

Which regions and property types will be the priciest in 2045?

Getting on the first rung of the property ladder is a huge step for many young people. However, with the average home costing £268,548, it takes first-time buyers around seven and a half years to save for a deposit. As house prices continue to rise, this trend can only increase.

But how much will it cost to buy a house in 20 years, and when will younger generations need to start saving 10% of their annual salary each year for a deposit?

By analysing trends in house prices over the past decade, Sell House Fast has forecast average house prices across the UK by 2045. Using projected salary data, we’ve also calculated the average deposit cost and the year younger generations will need to start saving for their dream home.

The average UK home will cost more than half a million pounds by 2045

According to our research, the average cost of a home saw a compound annual growth rate of nearly 4.26% between 2015 and 2025. This means the average home has increased in value by this rate each year. The average home could cost £670,000 in 20 years if current trends continue.

Growth can vary across different property types, so we’ve forecasted house price data across four categories to predict distinct trends in house price appreciation.

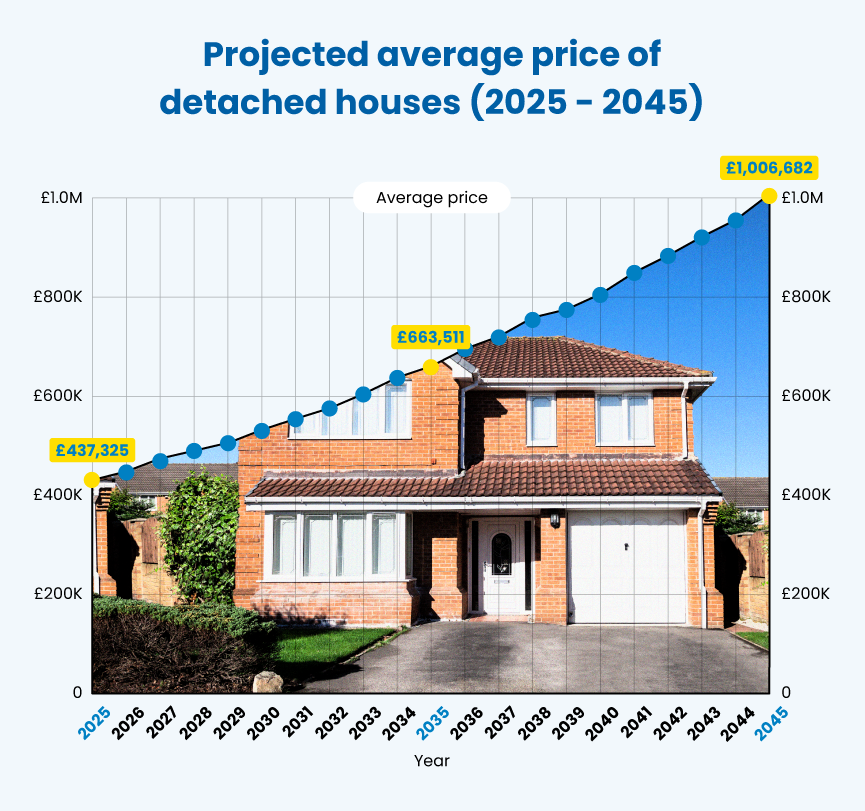

Detached houses

By 2045, detached houses are projected to reach an average price of over £1 million, 2.3 times more than the 2025 average of £437,325. If current trends continue, Middlesbrough will be the cheapest area for detached houses in 2045 at just under £400,000, five times more than the projected annual salary (£79,261). This is six times more affordable than London (£2.3 million).

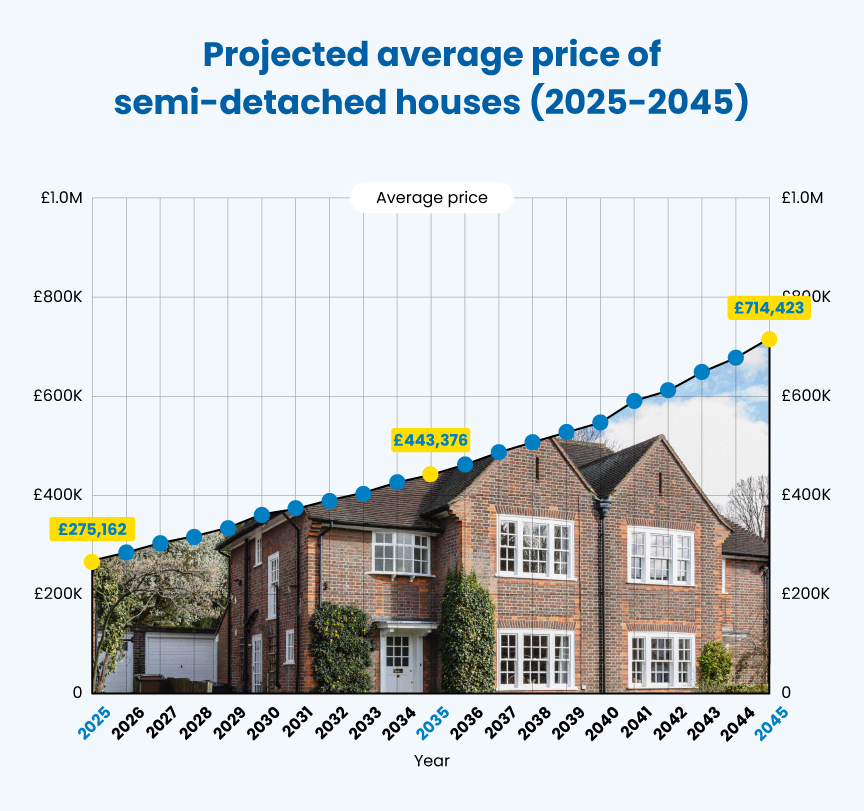

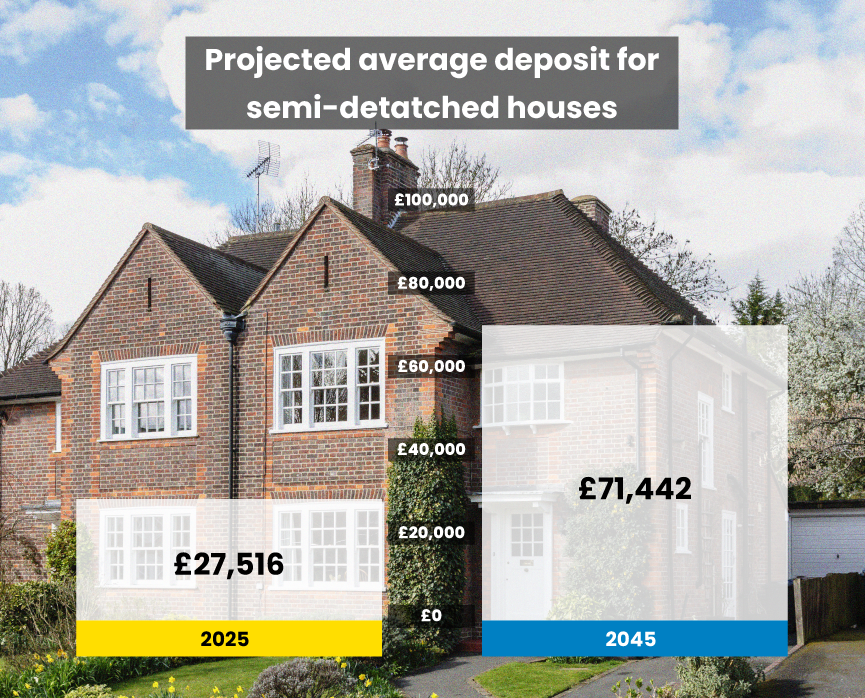

Semi-detached houses

Over the past 10 years, prices for semi-detached houses have risen by an average of 5% each year. Forecasting this trend, a semi-detached house is projected to cost an average of £714,423 in 2045.

Manchester’s semi-detached houses have seen the highest compound annual growth rate over the past decade (7.32%), meaning the city’s property prices are rising the fastest. However, by 2045, properties will be worth £1.3 million, £238,000 less than London (£1.6 million).

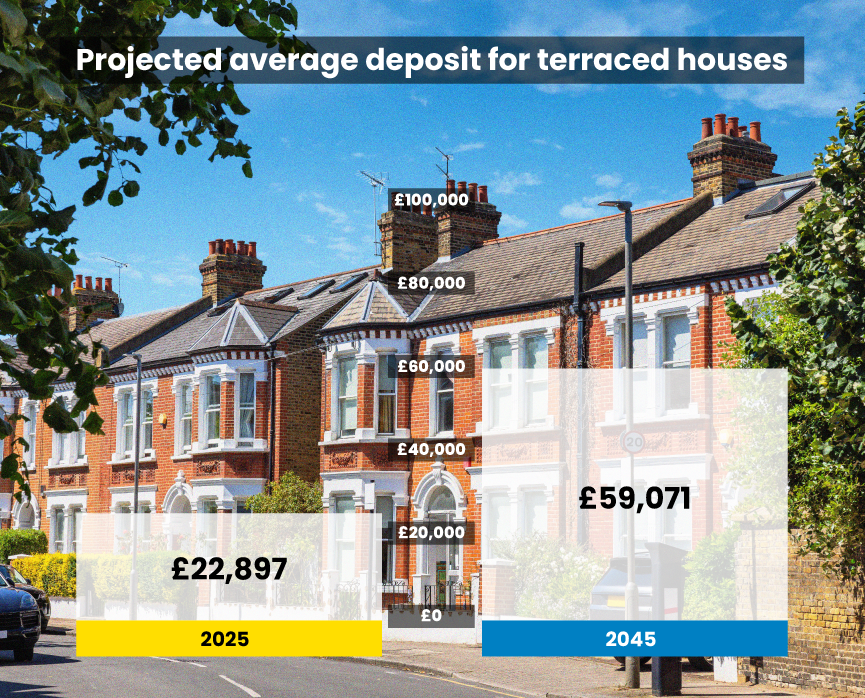

Terraced houses

According to our research, the average price of a terraced house is £228,968 in 2025. Since 2015, terraced house prices have grown by 4.85% per year. Using this growth rate, we can estimate that properties of this type will average £590,712 in the UK in 2045.

Like other property types, London will have the highest average price for terraced houses in 2045 (£1.3 million). Bristol won’t be far behind. In 20 years, terraced houses in the southwestern city will average £1.2 million, 15 times more than the projected annual salary (£77,886).

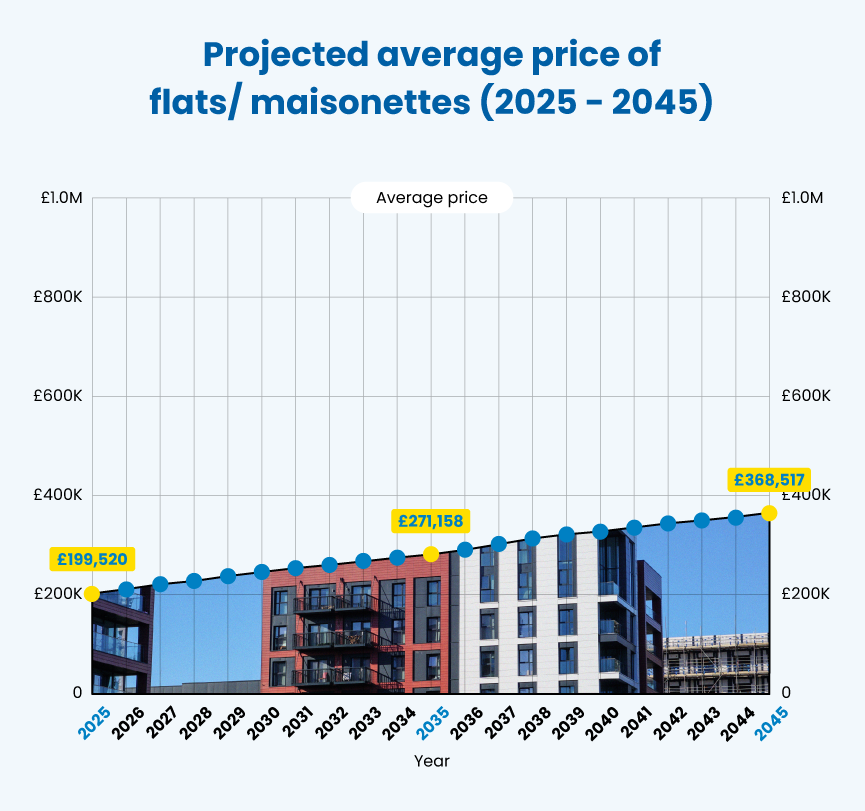

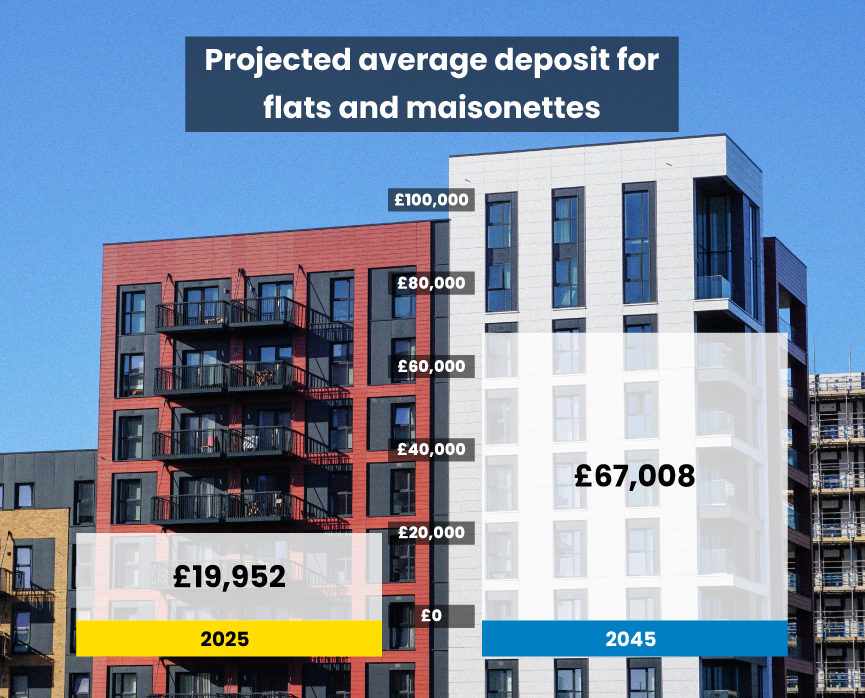

Flats and maisonettes

Often the cheapest property option, flats and maisonettes in the UK are projected to cost an average of £368,517 by 2045. Properties of this type are appreciating at the slowest rate, with a compound annual growth rate of 3.12% since 2015.

According to our projections, the North East will be the cheapest region for flats and maisonettes in 20 years, with Middlesbrough averaging £111,517 and Sunderland averaging £117,208. Bigger cities in the area, like Newcastle, are projected to attract higher prices (£207,781).

In 20 years, first-time buyers will need an average deposit of £74,000

Saving for a deposit is the first and most crucial step in home ownership. In 2025, the average 10% deposit in the UK will set buyers back £28,524. According to current trends, this could rise to £74,547 by 2045. Flats and Maisonettes are projected to require the lowest deposit, at £67,008, while detached houses will average £100,668.

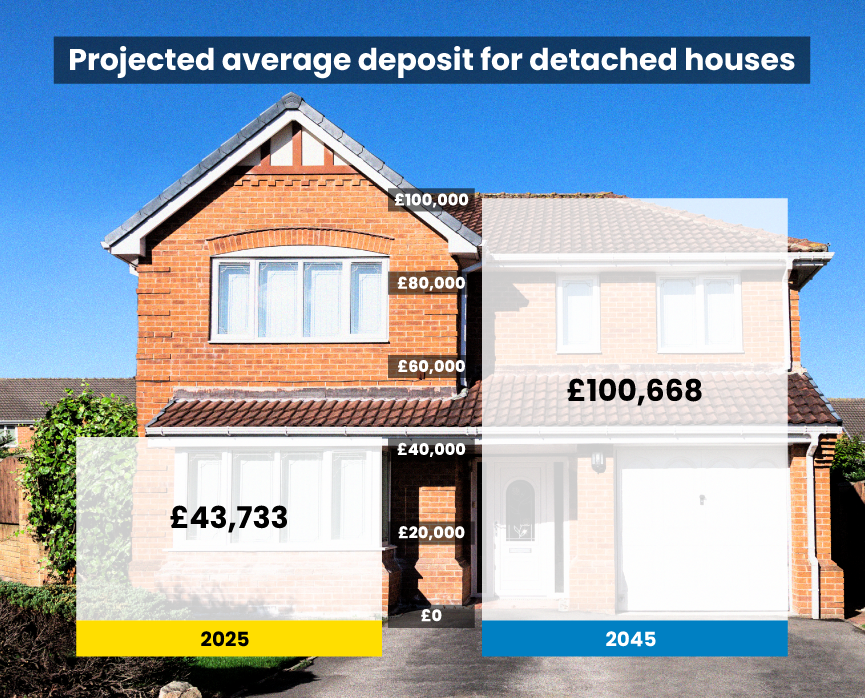

Detached houses

As detached houses will be the most expensive property type in 2045, deposits will also be the highest, costing buyers £100,668 on average, more than double the current deposit (£43,733).

According to current trends, detached houses in southern areas will need the highest deposits. London ranks top with a deposit of £238,204. However, Manchester also ranks in the top 10 for the highest deposits in 2045 with £182,615.

Semi-detached houses

According to our forecast, in 20 years, the average deposit for a semi-detached house in the UK will total £71,442. This equates to over four-fifths (84%) of the projected annual wage in 2045, £84,945, slightly higher than 2025’s rate of nearly three-quarters (73%).

If current trends continue, buyers in London will need the highest deposit for a semi-detached house (£160,166) in 2045, while some buyers in northern regions will need a lot less. Buyers in Liverpool, for example, will require a £61,460 deposit, just under the city’s projected annual salary of £63,525. This is nearly £100,000 less than London.

Terraced houses

In 2045, the average UK buyer of a terraced property will need to save up nearly £60,000, two and a half times more than the £22,897 average in 2025. As deposits are tied to property prices, those in London will have to save up the most projected salary (£76,618) for a deposit (£135,698).

Flats and maisonettes

Along with the cheapest property prices, flats and maisonettes will also require the lowest deposits by 2045, an average of £67,008, 3.3 times more than the UK average for this property type in 2025 (£19,952). Like property prices, deposits will cost less in northern England, except for Manchester, which has a projected average deposit of £68,014, slightly over the projected average annual salary in the region, £67,318.

According to our projections using data from the past decade, by 2045, it will take an average of nine years to save for a 10% house deposit, based on the average number of years needed to save for a deposit across the four property types we looked at. This is 18 months longer than in 2025.

Deposits for flats and maisonettes will take the shortest time to save, at just under eight years, while detached houses could take just under 12 years.

Detached houses

Average annual earnings are projected to reach £84,945 by 2045. With the average deposit for a detached house estimated at over £100,000 in 20 years, it could take 11 years and eight months of saving to afford a 10% deposit on a detached house.

Thanks to the slow projected wage growth in the region (2.52%), buyers in Watford will be saving the longest for a deposit on a detached house. According to our study, it could take 37 years and nine months to save the £216,008 needed for a 10% deposit in 2045, as wages in the area are predicted to reach £57,157 by 2045. This means people wanting to buy a detached house in the area technically should have started saving in 2007.

Semi-detached houses

According to our estimates, based on an average salary of £84,945 and an average deposit cost of £71,442, saving for the average semi-detached house could take up to eight years and four months by 2045. This is over a year longer than the current average of seven years, four months.

It could take Londoners longer than the rest of the country to save for a deposit. With a predicted gross annual pay of £76,618 and deposits averaging £160,166 by 2045, the average time is predicted to reach almost 21 years in the capital.

Terraced houses

By 2045, the average deposit for a terraced house in the UK could take around seven years to save up for. This is only slightly higher than the current average for this property type, which is six years and one month.

Despite most areas in the south having the longest time to save for a deposit, Manchester is the exception. People looking to buy a terraced house in the city must save a tenth of their income, projected to be £67,318 annually from 2030, to afford a 10% deposit by 2045.

Flats and maisonettes

Due to being the cheapest property type, flats and maisonettes will take the shortest time to save for a deposit in 2045, averaging just under eight years. This represents a 28% increase from the 2025 average, five years and three months.

Thanks to a relatively high projected deposit cost of £68,014 by 2045, it will take Mancunians the longest to save for a deposit on a flat or maisonette, just over 10 years. London is in second place, at nine years and four months.

Jack Malnick, Managing Director of Sell House Fast, comments on future expectations of the UK housing market:

“As house prices continue to rise, our forecast suggests the average UK home could cost £670,000 by 2045. Detached houses are expected to reach the £1 million mark on average by this point.

“This long-term growth suggests sustained demand and regional disparities between the north and south, which will likely increase over time, excluding for Manchester. According to our predictions, Manchester will consistently rank in the top 10 areas with the longest times needed to save for a deposit. Manchester’s flats and maisonettes have seen the highest compound annual growth rate over the past 10 years (6.12%). This means by 2045, it could take more than 10 years to save for a deposit, just under a year longer than in London.

“First-time buyers may face increasing difficulties in 20 years, with the average deposit rising to an estimated £67,000 and deposit saving time rising to nine years or more. As a result, younger generations will need to begin planning their financial future much earlier.”

Methodology

Beginning with the Land Registry’s Historical House Price Index, we took the average prices of detached, semi-detached, terraced houses, and flats and maisonettes from March each year between 2014 and 2025 for the UK overall and the 50 biggest towns and cities.

We then used CAGR Calculator to calculate the compound annual growth rate of house prices between 2015 and 2025. Using this figure, we could predict average house prices in 2045. We then divided this figure by 10 to predict the 10% deposit cost in 2045.

We calculated the compound annual wage growth rate between 2015 and 2025 using UK average yearly wage data from the ONS. We then used this figure to calculate average wages in 2045. Working on the basis that 10% of salaries will be used to save for a house, we calculated 10% of this figure. Using this data, we divided the average deposit cost by the average annual savings to determine how long it would take to save for a deposit in 2045.

To predict regional data, we repeated the process, using regional ONS data and house price predictions of the UK’s 50 biggest towns and cities by population.