House Prices are Up by 5.7%, ONS Stats Show

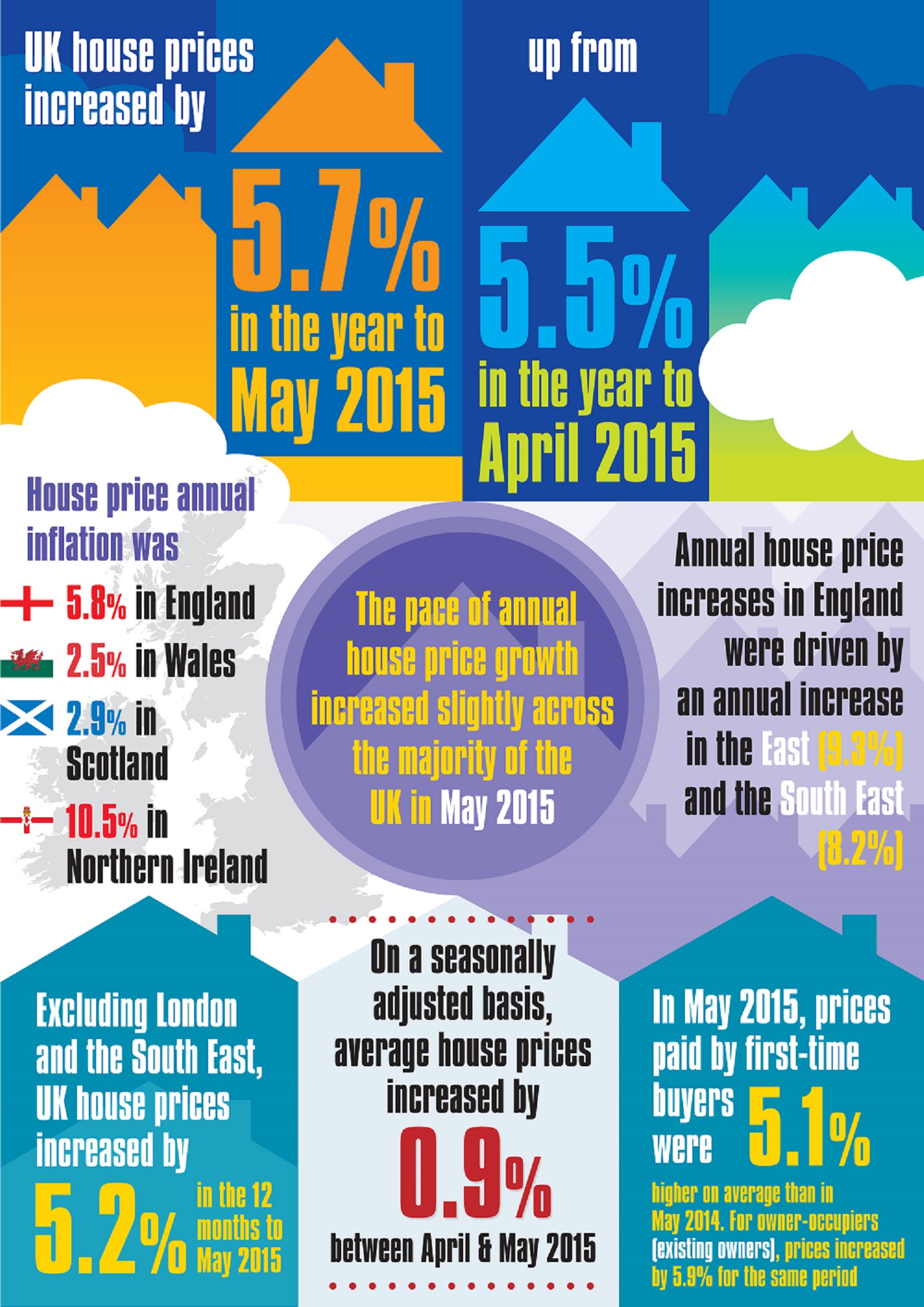

The Office for National Statistics (ONS) has today released the latest House Price Index, showing house prices are going up by 5.7% in the year to May 2015, a natural increase from 5.5% in the year to April 2015.

The monthly release of data by the ONS is calculated using mortgage financed transactions that are collected via the regulated mortgage survey by the Council of Mortgage Lenders, covering the majority of mortgage lenders in the UK.

Throughout the month of May, house prices in England were driven by an annual increase in the east of 9.3% and the south east of 8.2%. House price inflation was 5.8% in England, 2.5% in Wales, 2.9% in Scotland and 10.5% in Northern Ireland. Excluding London and the South East, UK house prices have gradually increased by 5.2% in the last 12 months.

In May 2015, London continued to have the highest average house prices, averaging £503,000 and the North East had the lowest average house price at £154,000. The South East, London and East all fell into a higher band of house prices with the average house price at £210,000. This is great news for homeowners wishing for a quick home sale, as properties are in-demand and worth substantially more than ever before.

Share this Image On Your Site

But despite annual house prices going up, the annual growth rate remains below those seen in 2014, suggesting a mismatch between supply and demand across the housing market.

Mortgage demand

The Bank of England has asserted that demand for mortgages has subdued in recent months, a reflection of caution by many buyers and the impact of the Mortgage Market Review. However, demand is expected to increase in the second quarter of the year and mortgage approvals were 5.8% higher in the three months to May, than in the previous three months.

Furthermore, house prices paid by first time buyers were 5.1% higher than in May 2014 and for owner-occupiers, prices increased by 5.9% for the same period.

Stephen Smith, director of Legal & General Mortgage Club and Housing, has commented that:

“A balance between supply and demand is key to the health of the UK housing market. The current level of supply is failing to keep up with demand, which is pushing up house price inflation.”

Feature image credit: Ttatty/Shutterstock