The Leasehold System is Very Much Alive, Despite Government’s Measures

At the end of 2017, the Government banned leaseholds for almost all new build houses and announced new measures to “cut on unfair and abusive practices within the leasehold system.” The crackdown on what some call “feudal” practices has been announced in July 2016 due to a huge increase of concern about buying and living in leasehold properties.

The recent measures have been eagerly awaited by thousands of homebuyers who found themselves trapped in the leasehold system. However, there will be exceptions and the changes won’t apply for flats and existing leaseholds. The Government promised to deal with this issue as well but we are yet to see what will happen. For now, the leasehold system remains very much alive in both England and Wales. Based on the latest findings by Sellhousefast.uk, the leasehold system is perhaps more alive than ever before.

The Sales of Leasehold Properties Increasing, rather than Decreasing

In light of the changes of the leasehold system, Sellhousefast decided to analyse the Land Registry’s data on properties sold in England and Wales 2017. The company that provides quick property sales also looked at the data for previous years and found that the sales of leasehold properties have been increasing rather than decreasing even though the Government announced to act earlier in 2017.

Based on the Land Registry’s data for 2017, leaseholds accounted for 219,511 or 31.9% of all properties sold in England and Wales. In 2016, leasehold properties accounted for 26.9% of all properties sold. That’s a 1.2% increase from 2015 when leaseholds made up 25.7% of the property market. Sellhousefast’s investigation also reveals that of 219,511 leaseholds sold in 2017, 184,618 or 84.1% were existing properties and 34,893 or just 15.9% were new builds. Since the new measures do not relate to existing leasehold properties and new build flats, leaseholds are not going to disappear from the property market just yet.

Freehold Flats in England and Wales Virtually Non-Existent

It’s very common for flats in England and Wales to be leaseholds, no matter if they are new-builds or existing properties. Of all the flats sold in 2017, only 3,312 or 2.13% were freeholds, which means that freehold flats are virtually non-existent. Sellhousefast spoke to Alex Highman (47), one of the flat owners in Gemini Park, Borehamwood, who decided to buy-out their freehold. Together with other flat owners, he formed a limited company which completed on the freehold in November 2017.

He explained his view of the issue:

“If you have a landlord who is cooperative and allows you to change the site and make it better, then buying the freehold is pointless. Of course, once you own the freehold you no longer have to pay ground rent and renewing your lease is far cheaper. It all comes down to a balance of whether it’s worth the cost to those buying.

Due to our purchase of the freehold we can now pursue with the cooperation of everyone on site, as we have chosen to retain the Residents Association, bettering the site and making it a safer happier place to live.”

Investigation into the Leasehold System in England Reveals Major Differences

Share this Image On Your Site

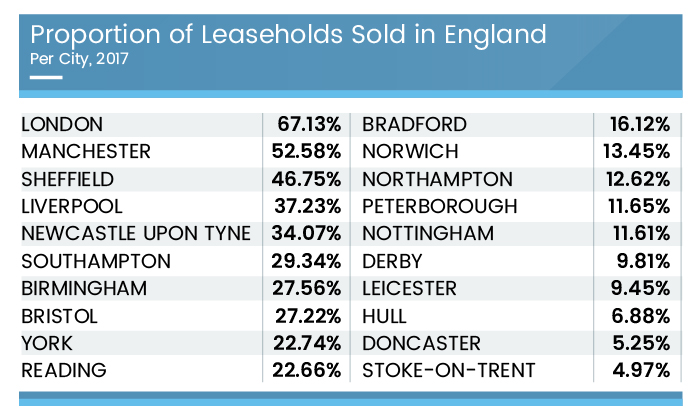

Sellhousefast looked at the share of leaseholds sold in the largest English cities in 2017 and found an astonishing difference between cities across England. The leasehold system was found to be most widespread in London and Manchester where leaseholds accounted for 67.13% and 52.58% of all properties sold, respectively. With leaseholds accounting for 46.75% of all properties sold, Sheffield had the third largest share of leasehold properties, followed by Liverpool (37.23%) and Newcastle upon Tyne (34.07%).

With leaseholds accounting for just 4.97% of all properties sold, Stoke-on-Trent was found to be the freehold capital of England. With leaseholds making up only 5.25% of the total property market, Doncaster closely fell behind Stoke-on-Trent. Doncaster was followed by Hull (6.88%), Leicester (9.45%) and Derby (9.81%) which is the last of the cities with leaseholds accounting for less than 10% of all properties sold.

Wales Still Awaiting a Solution

According to Daily Post, the Welsh Government plans to follow England’s lead, however, it remains unknown when similar measures can be expected. In the meantime, the leasehold system in Wales will continue to thrive with all its flaws.

Share this Image On Your Site

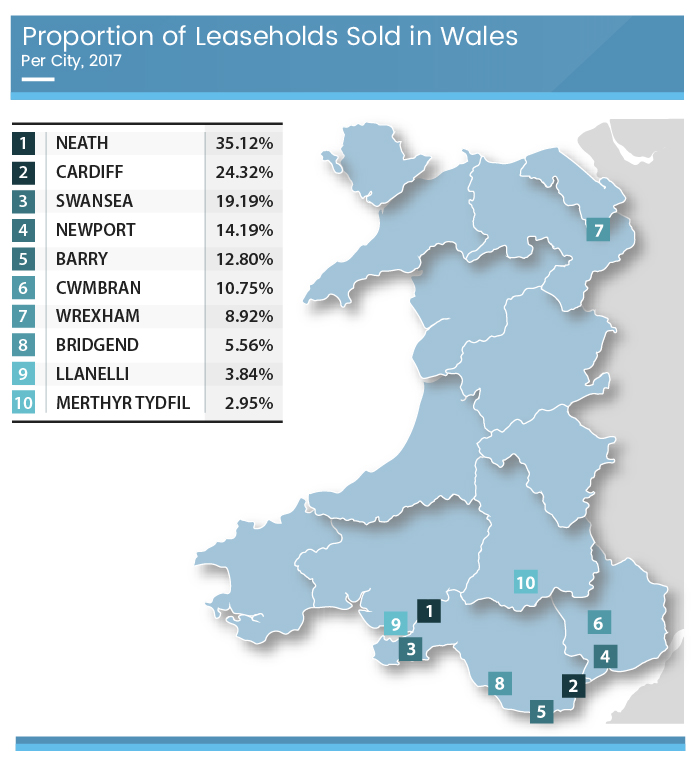

Sellhousefast’s analysis of the leasehold market in Wales in 2017 reveals that, just like in England, there is a major difference between the cities. With leaseholds accounting for 35.12% of all properties sold in 2017, Neath leads among the Welsh cities with the highest proportion of leasehold properties sold in the country. With leaseholds making up 24.32% of the total property market, the Welsh capital of Cardiff has the second highest proportion of leaseholds sold in 2017, followed by Swansea (19.19%), Newport (14.19) and Barry (12.80%).

With leaseholds accounting for less than 3% – 2.95%, Merthyr Tydfil was the least “leasehold-affected” city in Wales in 2017. Once the largest town in the country is followed by Llanelli (3.84%), Bridgend (5.56%), Wrexham (8.92%) and Cwmbran (10.75%).

The Leasehold System is Here to Stay

The Government’s measures against the “unfair and abusive” practices within the leasehold system has been widely regarded as a major victory, however, the leasehold system is here to stay. And according to critics of the recent measures, it will soon need another intervention.

Robby Du Toit, MD from Sellhousefast.uk commented:

“We are yet to see how the Government will solve the issue of the existing leaseholders and how the latest measures will affect the property market. I’m afraid that the existing leaseholders will probably have to lower the asking price considerably if they want to sell. I can’t imagine who will want to buy a property with preposterous ground rents, especially now that the Government promised to set the ground rents on new long leases – for both flats and houses – to zero.

Another thing that worries me is that a lot of leaseholds are held by investors who obviously want to make the most out of their investment. I’m concerned that they might try to exploit the loop holes in the new measures to continue to profit from the leasehold system.”