London’s Single Tenants Sacrifice More Than 50% of Their Monthly Salary on Rent

Property prices in London are notoriously some of the most expensive in the world. With wage inflation stagnating below the upsurge in property prices, it has become very difficult for those looking to get a firm foothold on the London property ladder. Many people have therefore been forced into the private rental sector and some others had no option but to rent after failing in their efforts to stop repossession by banks. Therefore the rental sector has seen phenomenal growth in recent years signified by nearly one in three London household’s renting privately. In fact, research by accountancy firm PwC suggests that by 2025, London will primarily become a city of renters with only 40% owning their own home.

Despite the positive growth for the sector itself, the increased demand has driven up private rental values. This has largely been attributed to landlords, who have taken advantage of property seekers rising appetite for renting by increasing their prices. Unfortunately, existing tenants and property seekers alike have had to tolerate this ‘opportunistic behaviour’, mostly due a lack of affordable alternatives as well as a shortage of new-builds.

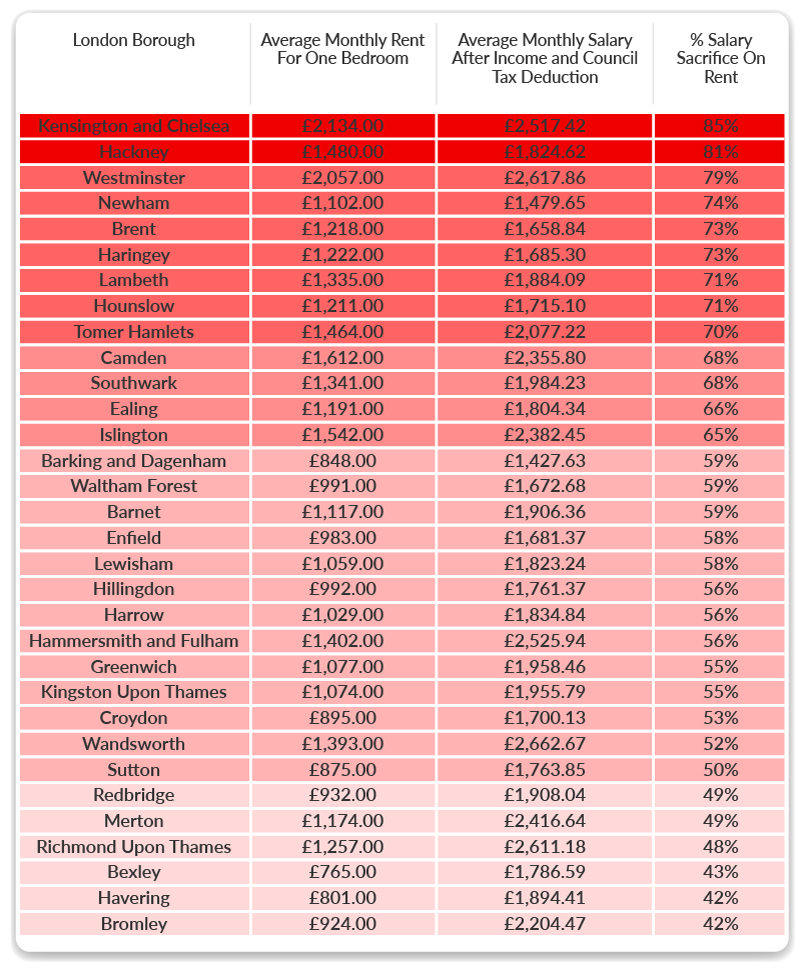

At sellhousefast.uk, we wanted to find out what percentage of single tenant’s monthly salary (after income and council tax deduction) is taken from renting a one-bedroom property in their respective London boroughs.

Photo credit: pixelbliss/Shutterstock

Methodology

Utilising data from the Office of National Statistics (ONS), we individually found out the ‘mean’ rental value for a one-bedroom in each of the 32 different London boroughs. We opted to use the mean rather the median figure, as it is likely to be more representative of the general population in that borough. The median figure is simply the middle value from all the responses gathered regarding how much rent, residents in each of the boroughs pay. On the other hand, the mean value takes into consideration all the varying values that residents pay in rent by adding them up together and dividing them up by the response rate in each borough.

The ONS’s definition of one bedroom are any self-contained properties which are houses, bungalows, flats and maisonettes.

The next step was to find out the monthly salary of the residents in each of the 32 boroughs. This data was again sourced from ONS, who provided the weekly gross pay, which was then multiple by four to give the monthly gross pay. Since it was ‘gross’, it was before any taxes had been applied, we therefore adjusted each monthly salary to the appropriate tax bracket. For all the boroughs except for one (Kensington and Chelsea – 40%), the tax rate was 20%. The next step involved finding out the council tax that residents in each of the boroughs paid, which was sourced from Kinleigh Folkard & Hayward. This was best reflected by ‘Band D’ – which is often referred to as the average council tax rate. Once the ‘Band D’ council tax rate was found for each of the boroughs, it was then deducted from local resident’s monthly salary after income tax. Thus, providing the exact figure for single tenants average monthly salary in each borough after income and council tax deductions.

The final step simply involved dividing the mean (average) rental value of a one-bedroom in each borough by single tenants average monthly pay and then timings it by a hundred to show what percentage of their salary (after income and council tax deductions) they sacrifice on rent.

The Findings

Share this Image On Your Site

The data astoundingly revealed that single tenants in 26 of London’s 32 boroughs sacrifice 50% or more of their monthly salary on rent for their one-bedroom property. Perhaps unsurprisingly, those single tenants residing in a one-bedroom property in Kensington and Chelsea sacrifice 85% of their monthly salary on rent – the highest out of all the London boroughs. Single tenants in Kensington and Chelsea are closely followed by those in Hackney – who give up 81% of their monthly salary to pay rent for their one bedroom property. Westminster is third, where single tenants use 79% of their monthly salary to pay for rent on their one bedroom property.

Out of all the 32 different London boroughs, single tenants in Bromley as well as Havering sacrifice the joint lowest percentage of their monthly salary on rent for their one bedroom properties at 42%. Comparatively, single tenants in Bexley give up slightly more of their monthly salary on renting a one bedroom property at 43%.

With most single tenants in London’s different boroughs sacrificing a huge percentage of their monthly salary on rent for their one bedroom property – those who have ambitions of owning their property are left with no hope. Other living expenses such as food, utilities and transport also eat up a huge proportion of their reaming monthly salary (after rent, income and council tax deductions), therefore many could potentially lack a sufficient stream of money to save for a deposit or seriously consider better alternatives. This could adversely transpire to them being stuck in the infamous ‘generation rent’ trap whereby they never become homeowners if they wish to stay in London for the foreseeable future.

On some positive news, the data did show that only 10 out the 32 London borough’s average rent per a month for a one bedroom property was greater than the London average of £1,329.00.