Properties in London are 11.37 times the average salary – but who is better off?

Buying a house is never a simple process, and comes with several financial complications to say the least. House prices in the capital is a particularly daunting topic, especially when you are a first-time buyer. So many questions will enter your head, from mortgages, to ISAs, and suddenly the realisation that you do not truly understand what stamp duty is.

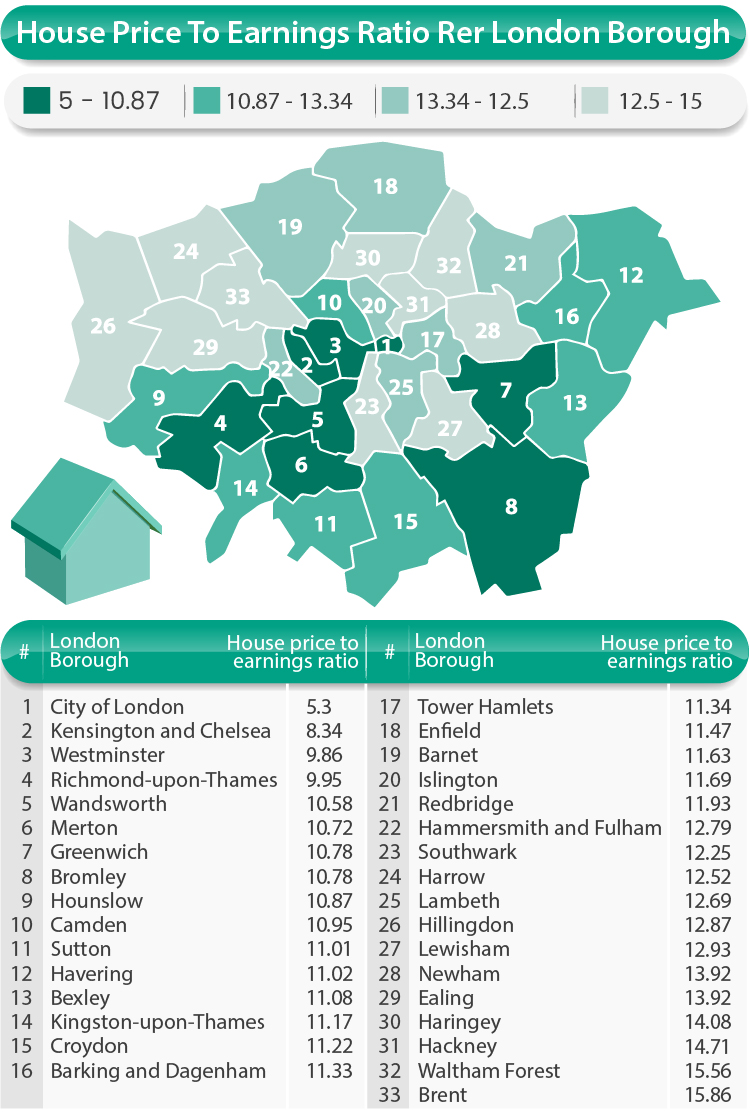

Research by Sell House Fast investigated the affordability of every London borough, by exposing the average wage in each borough and what the average house price is in the current climate, by assessing data from the latest ONS findings (UK House Price Index and HMRC Survey of National Income).

Share this Image On Your Site

How much do you need to earn for a house in London?

Findings discovered that typically homes in London are 11.37 times more the average earnings as a whole. Having broken down the research, it was exposed that the average house price stands at £553,068, whilst the average wage of Londoners is £49,140. However, as discovered, there are places to buy which are more ‘affordable’ when comparing to annual earnings.

The boroughs most ‘affordable’, in relation to house prices were those in typically more affluent areas: City of London was the most affordable, with house prices only 5.3 times the salary. Whilst the average salary of residents in The City of London stands at £144,000, houses cost just £763,748, which is in fact low compared to some of its neighbouring boroughs. However, this result could be identified as a statistical anomaly – with just 9,000 living in the City of London.

The other two boroughs being Kensington and Chelsea (8.34 times the salary) and Westminster (9.86 times the salary) are substantially higher, yet due to the salaries of those in the area, the house price to earnings ratio is low for London. Individuals in Kensington and Chelsea are earning £158,000 yearly on average, with houses on the market for £1,317,424. Whilst the annual wage of residing in Westminster stands at £104,000, house prices are £1,025,114, with a 9.86 affordability ratio.

Photo credit: 1000 words/Shutterstock

The least affordable places to live in London compared to average salary

On the other end of the scale were areas in London where some individuals do not live in such circumstances. Brent was ranked the worst place to buy in accordance with the average wage, where the average salary is £31,200, yet houses are a shocking 15.86 times more expensive at £494,913.

Additionally, in Waltham Forest, homes are 15.56 times the price of homes, standing at £438,855, though the average salary is just £28,200; a massive £20,000 less than the average London salary. Those therefore living in Brent and Waltham Forest would struggle to step onto the property market in these areas, where homes are almost sixteen times the annual wage.This also explains why many homes in these areas are facing threats of repossession by banks.

Coming third from bottom, as the least affordable place to buy in London is the borough of Hackney. Although residents there are on a higher wage than those in several other regions (37,100), the average house price stands at £545,921; almost the overall average in London. However, there are eight boroughs, where the standard income is higher, yet house prices are considerably lower; including Bromley where the average income is £40,400, properties there are £109,717 cheaper than Hackney.

Some property experts may argue this is because of the up and coming urban vibe Hackney has to offer in recent years. With it being walking distance to so many of London’s central locations; close to places such as Liverpool street, the borough is being considered more central than ever. With new restaurants and bars, it is becoming increasingly trendy, with a number of new developments, which does of course mean and increase in house prices.

Photo credit: gumbao/Shutterstock