Reasons You May Be Refused A Rental Property

Property searches are often as stressful as they are fun. As you look through a range of properties; you are likely to find a handful of stunners (which are usually snapped up quicker than you can say ‘I’d like to book a viewing’), as well as a fair few houses with significant pitfalls (the tiny box room that could only feature doll-house furniture, and the broken boiler you only find out about when you move in). The likelihood is however, that it is only a matter of time before you find a property you set your heart on.

Once you’ve put a holding deposit on the property, showing your intentions are good, your prospective landlord or their agent will begin a series of checks. With all being well, you should be given your move in date, and a contract to sign. However, for some unfortunate prospective tenants, they do not pass their checks, meaning they are refused the option to rent the property.

But just what are the reasons why you may be refused a rental property?

Pets – not any more!

Some landlords state in their terms of contract/tenancy agreement that pets will not be permitted at the property. This meant that either you would have to re-home your pet or, search for a different property. Hiding a pet from your landlord will mean that you’ve broken your tenancy agreement, leaving them well within their rights to evict you…or at least that’s how it used to be.

However..

Recent changes brought in by the The Renters (Reform) Bill mean that a landlord can now not “unreasonably withhold consent” if you want to move your pet in which is brilliant news for tenants.

Children

In the U.K, it is not illegal for a landlord to state on the property’s terms of contract that he or she wishes for the property to be child-free. The landlord may choose to do this if they deem the property to be unsafe for children. This being the case; if you have children, you may simply want to explore other properties.

Image: Credit to Alena Ozerova / shutterstock.com

Salary

Typically, your salary should equate to two and a half times your annual rent or more. You may be refused a property if the ratio of rent to salary earnings is unfavourable.

As noted by HousingConnections.org:

“A general rule of thumb is that you shouldn’t spend more than roughly thirty percent of your income on rent, but that rule doesn’t factor in all of your expenses, and usually, neither do affordability calculators.”

Photo credit: Leszek Glasner/Shutterstock

If you receive benefits

Similarly, it is not illegal for a landlord to specify that they do not wish to have tenants who are on housing benefits. Reasons, as listed by the Guardian may include:

- Payment in arrears: Local Housing Allowance (LHA) is not always paid directly to the landlord furthermore, the payments are nearly always made in arrears. This is somewhat less favourable to being paid in advance per calendar month.

- Deposits: Those on LHA often lack a property deposit. Local governments, who typically help in such a scenario are often slow when it comes to wading through forms and red tape.

- Red tape: Payments can be intermittent with little or no notice. Councils also retain the right to try to retrieve past payments from landlords should it later emerges that their tenant was claiming fraudulently.

- Attitudes: Unfair perceptions claiming housing benefit are more likely miss rental payments or to not look after properties properly.

- Insurance traps: Higher buildings and contents insurance premiums often deter landlords from letting to people who receive LHA.

- Buy-to-let mortgages: Under some buy-to-let mortgage loan’s terms and conditions, landlords are not permitted to let to tenants on benefits or income support.

- Constant change: The confusing nature of changes made to the housing benefit system, rates of payment and rules has led to many private landlords making the choice to opt out, rather than trying to ‘keep-up’ and understand the intricacies of the matter.

Image: Credit to 1000 Words / shutterstock.com

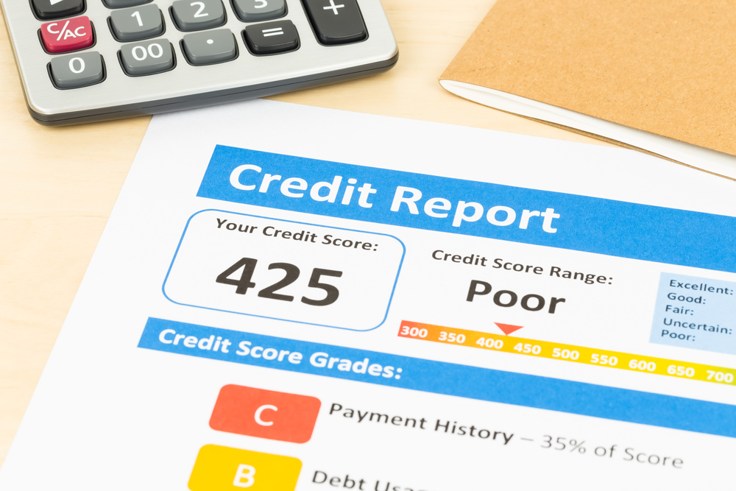

A poor rating on your credit score check

What is a credit score check?

Before moving into a rented property, the landlord and letting agency will want to do a few checks to see if you are indeed who you say you are, and to check that you can pay the rent you propose to pay. You’ll be asked to fill out some forms with your personal details and you will likely be asked to provide some references; these may come from your employer or former landlords. Once your credit history has been checked and your references have been approved, you and your prospective landlord will be informed. It’s a relatively simple process, one that everyone who wished to rent (or buy) a property will have to undertake. Nevertheless, there are aspects of your spending history that can let you down and give you a low credit rating score.

Image: Credit to Casper1774 Studio / shutterstock.com

Reasons for a low credit rating score

High levels of existing debt:

This may indicate that you are already struggling to manage what you already have, so shouldn’t take on extra financial impositions/responsibilities.

Being late with credit card payments:

Being timely in your payments and having the ability to manage your money and affairs is essential when renting a property. Having late credit card payments would suggest that these skills need improving upon before looking to rent a property.

Image: Credit to A. and I. Kruk / shutterstock.com

Applying for lots of credit at once:

With the applications appearing on your credit report, it may appear that you are experiencing financial difficulties.

Missing a monthly payment on a loan:

Landlords value stability. They want to know that you can make your monthly payments in full, on time. Even if you have the capital, missing a payment may show you to be an unreliable future tenant.

Being declared bankrupt:

Bankruptcy would indicate a lack of available finances and that the prospective tenant is potentially poor at managing their finances.

Image: Credit to Antonio Guillem/shutterstock.com

Entering into an Individual Voluntary Arrangement (IVA):

An IVA suggests that you are struggling with money and need to have repayments chunked into affordable amounts.

Having a County Court Judgment against their name:

This would suggest that you have a poor credit history.

Financial Association:

If you share a bank account, mortgage or loan with your partner (or anyone else for that matter) who has bad credit, your credit score is likely to be adversely affected too.

Image: Credit to Naypong / shutterstock.com

Never having previously borrowed any money:

If you have never borrowed money to prove that you can pay it back, it will be hard to prove that you will be a reliable source in terms of credit and making payments.

Having open credit cards accounts that you never use. As part of your credit score, your available credit will be checked on across all accounts. Having too high a credit limit may suggest poor money management.

Only borrowing small amounts of money:

Loans often come with interest. Your loan is effectively a business proposition – small loans offer little profit, so are not overly desirable to lenders.

Image: Credit to FIRDAUS ZULKEFILI/shutterstock.com

Mistakes on your credit report:

Someone who fraudulently applies for credit in your name may be causing a great deal of damage to your credit score. Contact the credit reference agency; they should be able to investigate and remove any fraudulent activity.

Not being on the electoral register:

This is one of the methods of verifying that you are who you say you are.

Image: Credit to AnglianArt / shutterstock.com

Only making the minimum payments on your credit card every month:

This suggests that you are struggling to manage your debts.

Moving house frequently:

As previously mentioned, landlords and those who check your credit score will wish to see some form of stability. Constantly moving will suggest that you will not be at the property long and that your means of income may fluctuate also if your moves necessitate new jobs.

Image: Credit to Monkey Business Images / shutterstock.com

Feature Image: Credit to Antonio Guillem / shutterstock.com