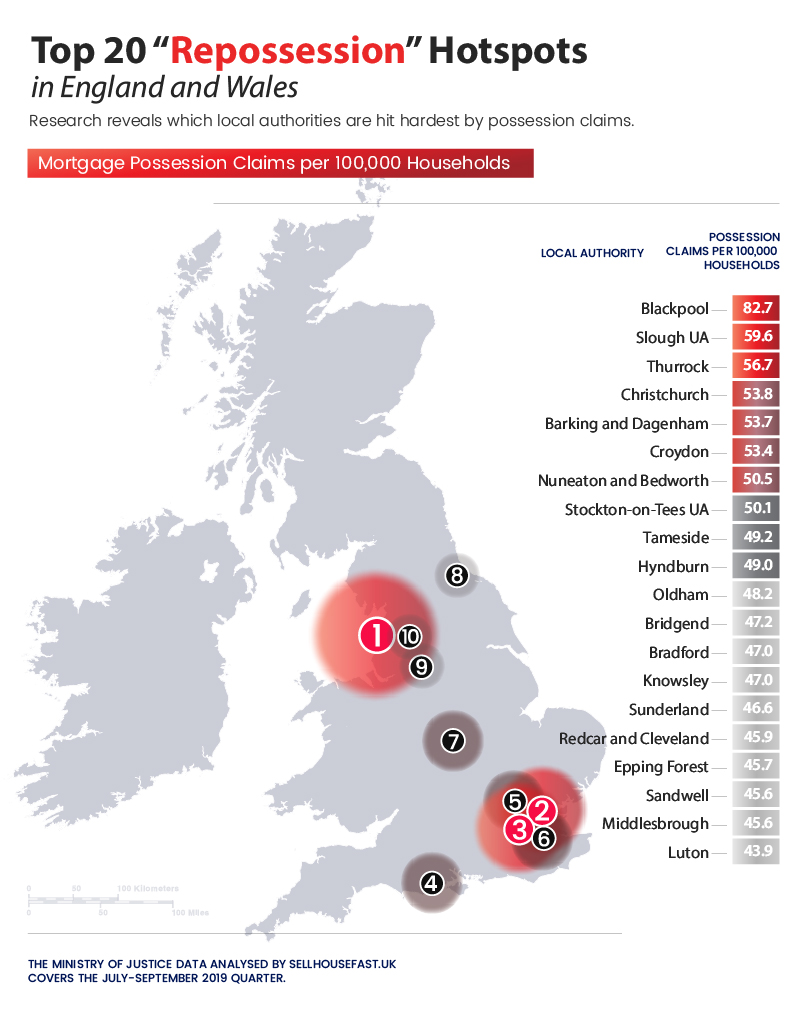

Top 20 Mortgage Possession Hotspots in England and Wales

The November 2019 release by the Ministry of Justice shows all mortgage possession actions in county courts increased in 2019.

According to the repossession statistics, in 2019, mortgage possession claims increased by 42% while orders for possession rose by 35%.

Warrants issued and repossessions also increased by 31% and 29% respectively, compared to the same quarter in 2018.

Sell House Fast, who offer advice on how to stop house repossession, investigated this to determine the local authorities in England and Wales most at risk.

Please note: analysis covers the July to September quarter in 2019 only.

Where do most repossessions happen in England and Wales?

In the July to September quarter, Sell House Fast identified Blackpool as the most affected area in England and Wales. The seaside resort holds 82.7 (83) mortgage possession claims per 100,000 households.

Followed by Slough, 20 miles west of central London – at 59.6 (60) and Thurrock in the east – at 56.7 (57.)

Closing the top twenty, but still rich in risk, are local authorities: Sandwell (45.6), Middlesbrough (45.6) and Luton in the south east (43.9.)

Where do the fewest repossessions happen in England and Wales?

Alternately, Sell House Fast identified the three local authorities with the fewest mortgage possession claims as: Broadland (5.3 per 100,000 households), Woking (4.8) and Maldon at 3.6.

As per the repossession statistics, Isles of Scilly had no mortgage possession claims in this period.

For a 2018-2019 comparison of UK repossession statistics, specifically mortgage possession claims, please see below:

| Local Authority | Mortgage Possession Claims 2018 (Per 100,000 Households) | Mortgage Possession Claims 2019 (Per 100,000 Households) | % Difference |

| Blackpool | 42.1 | 82.7 | 96.4 |

| Slough UA | 28.4 | 59.6 | 109.8 |

| Thurrock | 45.6 | 56.7 | 24.3 |

| Christchurch | 4.4 | 53.8 | 1122.7* |

| Barking and Dagenham | 33.6 | 53.7 | 59.8 |

| Croydon | 32.6 | 53.4 | 63.8 |

| Nuneaton and Bedworth | 23.6 | 50.5 | 113.9 |

| Stockton-on-Tees UA | 28.8 | 50.1 | 73.9 |

| Tameside | 34.4 | 49.2 | 43 |

| Hyndburn | 43.3 | 49 | 13.1 |

| Oldham | 40.1 | 48.2 | 20.1 |

| Bridgend | 34.1 | 47.2 | 38.4 |

| Bradford | 33.9 | 47 | 38.6 |

| Knowsley | 37.7 | 47 | 24.6 |

| Sunderland | 25 | 46.6 | 86.4 |

| Redcar and Cleveland | 42.8 | 45.9 | 7.2 |

| Epping Forest | 16 | 45.7 | 185.6 |

| Sandwell | 28.4 | 45.6 | 60.5 |

| Middlesbrough | 57.7 | 45.6 | -20.9 |

| Luton | 20.4 | 43.9 | 115.1 |

*Please note: anomaly is the result of three areas coming together.

What are the main causes of mortgage arrears?

According to leading debt charity, StepChange mortgage arrears is – jointly with electricity bills and secured loans – a cause of concern for 18% of households* across the UK. Typically, the average arrears amount, relative to mortgage, is a total of £3,005.

*This percentage signifying the number of StepChange clients who have this type of expenditure who are in arrears.

Image credit: Shutter_M/Shutterstock

Image credit: Shutter_M/Shutterstock

How can I manage my mortgage arrears?

If you find you are struggling with priority debts and fear falling behind – don’t panic.

Try the following steps:

- Talk to your mortgage provider to see if they can offer you a lower payment on your mortgage. You may also be able to switch to an interest-only mortgage for a short period of time.

- Use an OFGEM-approved utility price comparison tool, to see if you can get a better deal on your gas, electric or fuel costs.

- Speak to your local council to find out if your property is in the correct council tax band.

It is also recommended you look at your budget to understand what your spending looks like monthly. Help can be found at StepChange via their helpline or the anonymous advice tool Debt Remedy.

What else can I do to stop repossession?

That’s where cash home buyers like Sell House Fast can help. We buy your house fast and are experts in being able to do so in time to stop house repossession.

Image credit: Africa Studio/Shutterstock

Feature Image credit: Billion Photos/Shutterstock