How will the recent change in stamp-duty affect buyers and sellers

The recent news regarding how stamp duty is to abolished placed Brits into two categories: those who see it as a gift from heaven and those who believe it will only make things worse for everybody in the long run.

Who will benefit from the change?

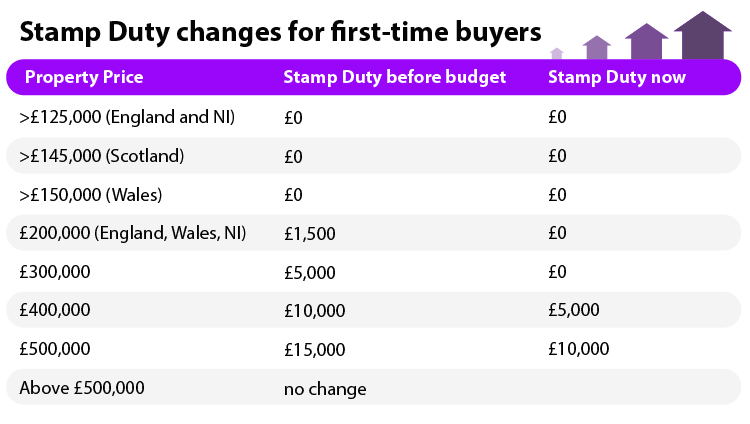

The change is meant to help first time buyers who are looking to purchase properties up to £500,000, with the stamp-duty being abolished on the first £300,000 of the deal, benefiting the vast majority of people. Chancellor Philip Hammond says that the average first-time buyer will save about £1,700 in stamp duty – this being the amount of stamp duty previously paid on the average property.

However, people who live in certain regions of the country such as the north of England, will notice little to no savings at all, as the stamp-duty is already very low. This is due to the fact that the average house prices in those regions are around £125,000, which is just above the English Stamp Duty threshold.

People who are struggling with raising money for a deposit will be able to spend the extra money saved from the stamp-duty on funding a hefty deposit instead. Considering that the average deposit for first time buyers is around £32,899, the money earmarked for stamp-duty won’t make a significant change, but it may increase the amount they can borrow, which means they might be able to buy a property which otherwise they would not be able to afford.

Potential downfalls

One potential issue that might have disastrous results for first-time buyers in the future, is the eventuality of house prices rising by 0.3%. This will mean that the actual beneficiers of the stamp duty abolishment are actually homeowners rather than first-time home buyers.

Property expert Henry Pryor commented in an article for the BBC that "pouring financial fuel on house prices will only result in even higher house prices, just as Help to Buy has done and as previous Stamp Duty holidays have."

In response, the Chancellor insists that young people will be the ones who benefit, as the decision to change the stamp duty comes in coordination with the decision to build 300,000 net homes per year. He added that "this is our plan to deliver on the pledge we have made to the next generation that the dream of home ownership will become a reality in this country once again."

Another issue brought up by the stamp-duty change affects house sellers who are owning a property worth just above £500,000, as the majority of first-time buyers will carefully choose to purchase a property bellow the price point in order to benefit from the tax change. This means that the property owners will have to slash their prices if they want to attract potential buyers.

If the change in stamp-duty was a wise decision or not, only time can tell.

Feature Image credit: Vlad Kochelaevskiy/Shutterstock