Average stamp duty land tax per London borough

Stamp duty land tax (SDLT) is the tax charged by the government when purchasing a property or land costing more than £125,000 in England, Wales and Northern Ireland.

The stamp duty rates an individual must pay will vary depending on the price and type of property (residential or non-residential). The tax applies to freehold and leasehold properties over £125,000 as well as if someone is buying with a mortgage or outright.

When should stamp duty land tax be paid?

Stamp duty land tax should be paid within 30 days of the date on which an individual is entitled to take possession of their new home. It is more than likely a solicitor or conveyancer will deal with the stamp duty land tax on the buyer’s behalf.

Regardless of whether tax is payable on a property or not, a buyer is obliged to provide a return to HM Revenue & Customs within 30 days of the completion of the transaction – if this is not done, the buyer could be issued with a significant fine.

Brief History

Stamp duty land tax was first introduced in 1694 to act as a transaction tax to primarily raise funds for the then war against France. Stamp duty land tax as we now know it was first brought around in 2003 by acting Labour chancellor of the exchequer Gordon Brown as a part of a new finance act.

What are the exemptions for stamp duty land tax?

- Certain ‘Right to Buy’ transactions may qualify for stamp duty discounts

- Charities seeking land or property for charitable purposes can get relief on stamp duty land tax

- Zero-carbon homes and flats under the value of £500,000 are except for stamp duty land tax

- Zero-carbon homes over the value of £500,000 can have their stamp duty land tax bill reduced by £15,000

- It should be noted that stamp duty land tax does not apply to removable fixtures such as carpets, curtains and freestanding furniture

- A divorce or separation whereby one partner is transferring their share of the property to the other

- If the property is a gift or left in a will

- If a property is listed over the £125,000 mark and the seller agrees to accept a lower offer on it

- Caravans, mobile homes or houseboats

Our research into stamp duty land tax in London

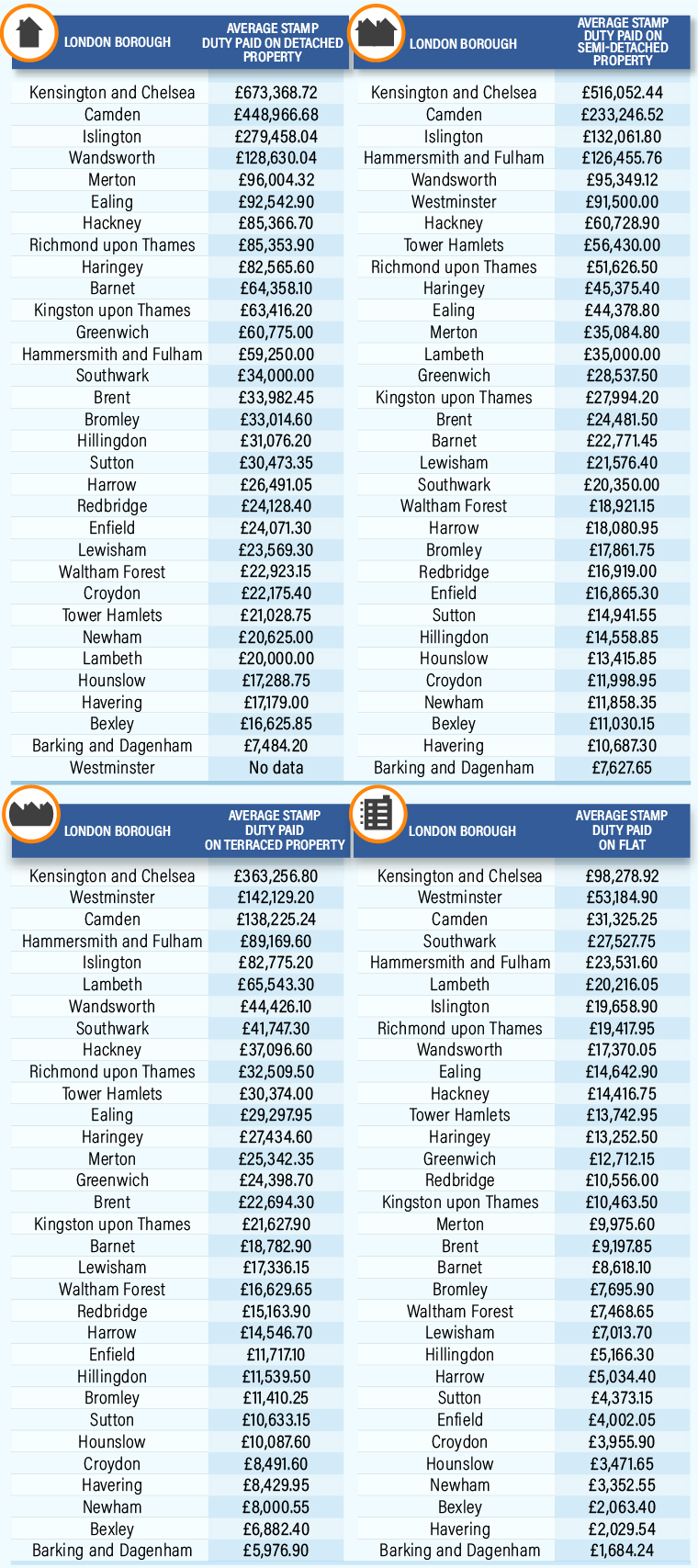

Interested in stamp duty land tax on residential properties in London, Sellhousefast.uk analysed data from Zoopla to find out the average price paid for four different types of property (detached, semidetached, terraced and flats) over the last 12 months in each of London’s 32 boroughs and then used the information to find the average stamp duty land tax paid on each of the property types sold in the area.

The findings revealed that new Kensington and Chelsea residents of detached and semi-detached homes paid the highest average stamp duty land tax on these two property types out of all the London boroughs at £673,368.72 and £516,052.44 respectively.

New occupants in trendy Camden thereafter paid the second highest average stamp duty land tax on both detached (£448,966.68) and semi-detached (£233,246.52) properties. Ranking third for the same property types were residents who had moved into Islington over the last 12 months, paying an average stamp duty land tax of £279,458.04 on detached and £132,061.80 on semi-detached properties.

With regards to terraces and flats, those in Kensington and Chelsea again paid on average the highest stamp duty land tax at a respective £363,256.80 and £98,278.92. New residents in the home of Parliament and Big Ben, Westminster, forked out the second highest on stamp duty land tax at an average of £142,129.20 on a terraced property and £53,184.90 on a flat. The third highest was new residents settling in Camden over the last 12 months, with them paying an average stamp duty land tax of £138,225.24 on a terraced property and £31,325.25 on a flat.

Individuals choosing to reside in Barking and Dagenham, on average paid the lowest stamp duty land tax on each of the four different property types at: detached – £7,484.20, semi-detached – £7,627.65, terraced property – £5,976.90 and flat – £1,684.24.