Britain’s Council Tax Debt

In an effort to shed light on the financial impact of unpaid council tax on local governance, Sell House Fast conducted a comprehensive freedom of information request targeting 315 councils across England.

Our inquiries focused on understanding the scope of council tax arrears, including the total number of cases, the three largest individual account arrears, and the extent of legal recourse taken, particularly in terms of referrals to court and bailiffs for recovery. This investigation aims to uncover not only the fiscal implications for local councils, but also the broader consequences for communities burdened by unpaid taxes.

Just how much does unpaid council tax cost our local councils?

Which UK councils are in the most arrears?

The UK Council Tax in the Most Debt

Unpaid council tax can have a significant impact on local councils. As arrears accumulate and more individuals struggle to make their payments, the financial strain on a council’s budget can become severe. To exacerbate matters, many councils are burdened by substantial debts from unpaid council tax from years ago.

Councils with the Biggest Council Tax Debt

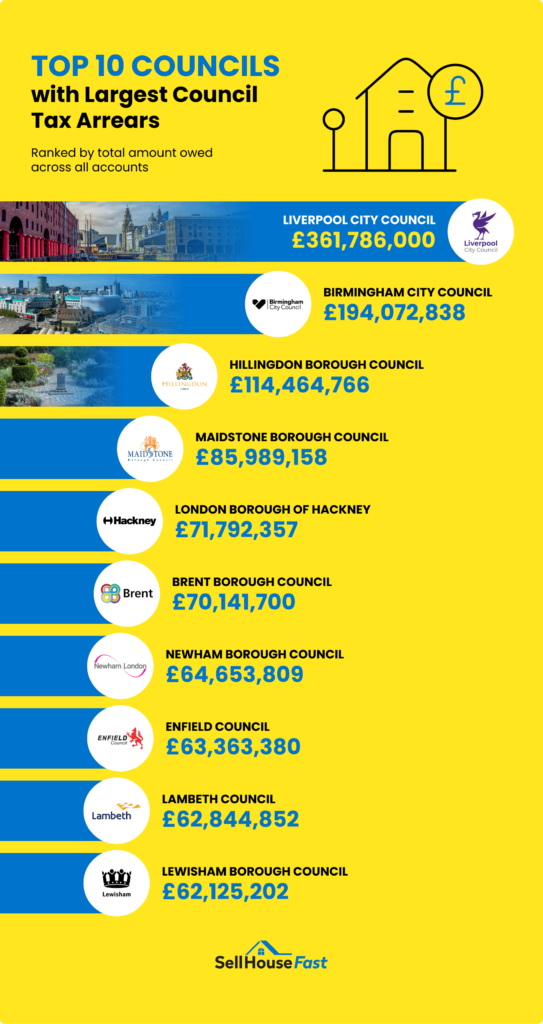

Our FOI requests revealed some startling statistics about council tax debt. The ten councils with the most significant debts were all densely populated urban areas, with seven of the top ten being London boroughs.

The two councils with the highest unpaid council tax debt were both outside the capital. At the time of the request, Liverpool City Council had the highest level of unpaid council tax debt, standing at a staggering £361,786,000. This level of debt placed Liverpool some distance ahead of Birmingham City Council, which was in second place with £194,072,838.

Such is the scale of the problem in Liverpool that in 2023, the council wrote off £25 million in unpaid council tax from years ago as part of an overall debt write-off package. Another FOI request this year discovered that the authority was currently pursuing two sitting councillors for unpaid council tax.

How the Regions Compare

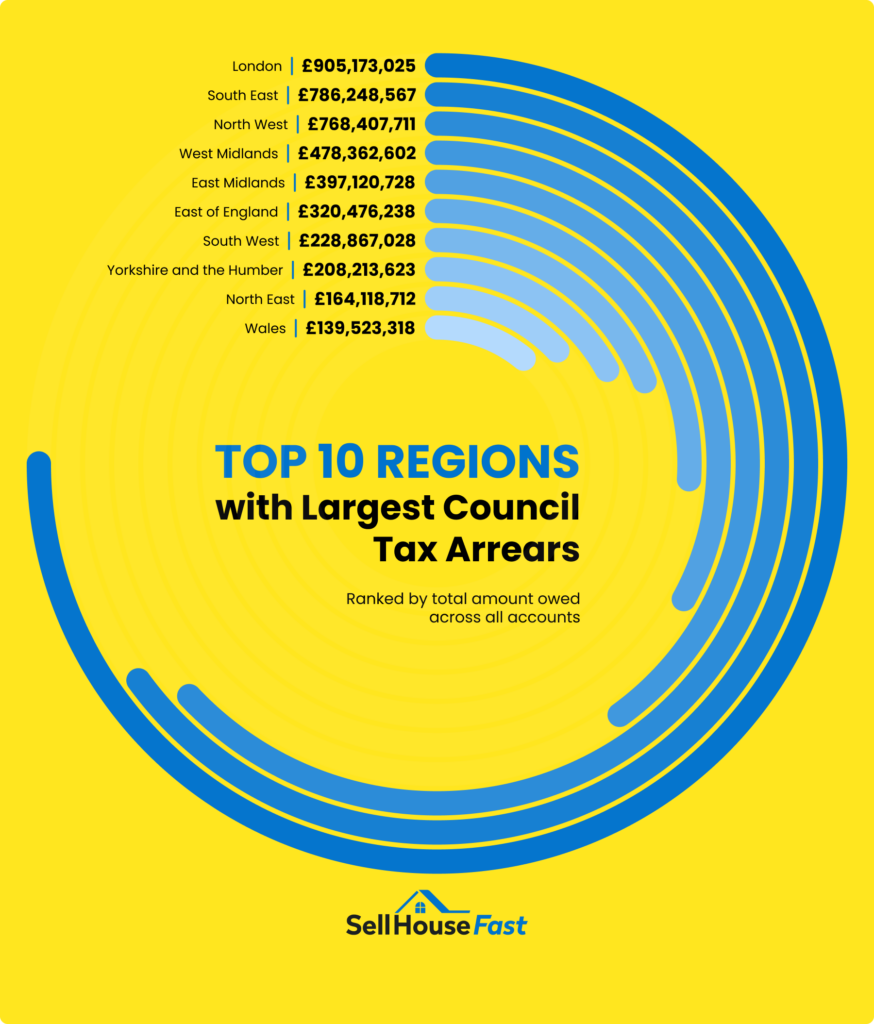

Home to nearly 9 million people and seven boroughs in our top ten councils with the highest council tax debt, it’s little surprise that London is the region with the highest debt levels overall. At the time of our request, local authorities across Greater London were owed £905,173,025 in unpaid council tax. Every year, around 300,000 unpaid debt cases in the capital ultimately end with bailiffs visiting the debtor.

The populous South East and North West were second and third with £786,248,567 and £768,407,711, respectively. The regions with the lowest unpaid council tax debt levels were more rural and less populated, with Welsh authorities sharing £139,523,318 of debt between them.

When it comes to the number of accounts indebted, the North West surpasses London, with 1,074,452 accounts indebted at the time of the request. The overall debt level in the North West is lower than London’s, suggesting large numbers of people with relatively low levels of unpaid council tax being owed.

For many people, unpaid council tax results from a drop in income due to losing a job, illness or other unexpected costs. When debts of all kinds mount up, many people look to relocate or downsize as an opportunity to free up capital, settle what they owe, and make a new start. With options available to help you sell your house fast, this can often be a practical move.

The Problem of Persistent Debtors

While large numbers of small-scale debtors may create headaches for local authorities, small numbers of people who owe significant amounts over several properties are particularly problematic. Birmingham City Council’s largest non-payer owes a staggering £641,777, with two more owing the authority around £465,000 each. These accounts have been in arrears for over four years and have been accrued over multiple properties.

These high-debt individuals with multiple properties are often a priority for debt recovery, but a handful of individuals continue to amass council tax debt despite attempted legal action.

The Impact on Local Services

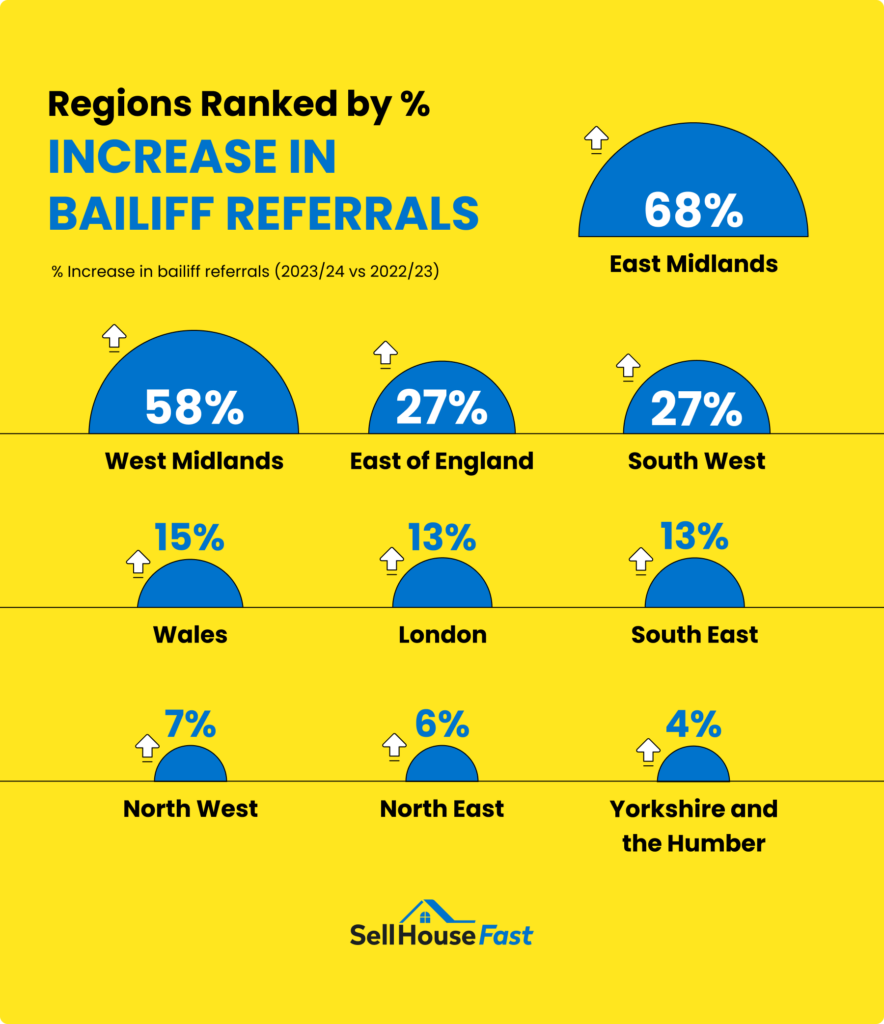

Getting the Courts involved and ultimately resorting to bailiffs is a lengthy and costly process. As many unpaid debts are relatively small, taking a legal route is not always cost-effective. As a result, local councils across the country sometimes write off council tax debt. That said, in highly indebted Birmingham, referrals to the bailiffs for council tax non-payment grew by 20% over 2022-2023.

Council spending plans take into account the expected receipts from council tax. When the percentage of unpaid council tax increases, this impacts budgets with cuts, ultimately reducing the level of services that local people receive. Budget shortfalls can also mean council tax bills rising for the majority who dutifully pay what they owe towards local services.

With councils across the country facing severe budgetary challenges, non-payment is likely to become increasingly prominent as authorities look to establish a firmer financial footing.

Methodology

In September, we submitted a freedom of information request for 315 councils across England and Wales, with a response rate of 84.13%. 50 councils did not provide a response.